Title: Practical Financial Management for PartTime Workers

In today's dynamic economy, parttime work offers flexibility and supplemental income. However, managing finances effectively while juggling parttime employment can be challenging. This guide provides a comprehensive financial management plan tailored specifically for parttime workers.

1. Budgeting Basics

Track Income and Expenses:

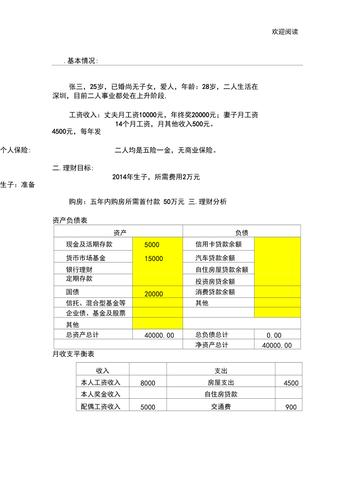

Start by calculating your monthly income from parttime work and any additional sources. Next, list all your monthly expenses, including rent, utilities, groceries, transportation, and discretionary spending.Create a Budget:

Allocate your income towards essential expenses first, such as rent and groceries. Then, designate a portion for savings and discretionary spending. Use budgeting apps or spreadsheets to monitor your expenses and stay within your budget.2. Emergency Fund

Importance of Emergency Fund:

As a parttime worker, having an emergency fund is crucial to cover unexpected expenses like medical bills or car repairs. Aim to save at least three to six months' worth of living expenses in a separate savings account.Automate Savings:

Set up automatic transfers from your checking account to your emergency fund each month. Treat this savings contribution as a nonnegotiable expense to prioritize financial stability.3. Retirement Planning

Utilize Retirement Accounts:

If your employer offers a retirement savings plan, such as a 401(k) or IRA, take advantage of it. Contribute a percentage of your income, even if it's modest, to benefit from employer matches or tax advantages.Invest Wisely:

Choose diversified investment options within your retirement account based on your risk tolerance and longterm goals. Consider seeking advice from a financial advisor to optimize your investment strategy.4. Debt Management

Pay Off HighInterest Debt:

Prioritize paying off any highinterest debt, such as credit card balances or personal loans. Allocate extra funds from your budget towards debt repayment to reduce interest charges and improve your financial health.Consolidate and Refinance:

Explore options to consolidate multiple debts into a single loan with a lower interest rate. Refinancing can help lower monthly payments and simplify debt repayment, making it more manageable on a parttime income.5. Additional Income Streams

Explore Side Hustles:

Look for opportunities to earn extra income outside of your parttime job. Consider freelancing, tutoring, or selling handmade crafts online. Diversifying your income streams can provide financial security and accelerate your savings goals.Invest in Skill Development:

Invest in acquiring new skills or certifications that can increase your earning potential in the long run. Online courses, workshops, or vocational training programs can enhance your qualifications and open doors to higherpaying opportunities.6. Tax Planning

Understand Tax Implications:

Familiarize yourself with tax laws and deductions relevant to parttime workers. Keep track of deductible expenses, such as mileage for workrelated travel or home office expenses if you telecommute.Maximize Tax Benefits:

Contribute to taxadvantaged accounts like Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs) to reduce taxable income and save on healthcare expenses.Conclusion

By implementing these practical financial management strategies, parttime workers can achieve financial stability, build wealth, and work towards longterm financial goals. Remember to regularly review and adjust your financial plan as your income and expenses fluctuate. With discipline and perseverance, even parttime employment can lead to financial success.

免责声明:本网站部分内容由用户自行上传,若侵犯了您的权益,请联系我们处理,谢谢!联系QQ:2760375052