小学生理财计划表手抄报

Teach basic financial concepts such as the difference between needs and wants, the power of compounding interest, and the importance of living within one's means. Use reallife examples to illustrate these concepts.

Encourage the student to set both shortterm and longterm financial goals. Shortterm goals could include saving for a new toy or gadget, while longterm goals might involve saving for college or a future car.

Instill the value of giving back by encouraging the student to donate a portion of their money to charity or participate in community service activities. This fosters empathy and a sense of social responsibility.

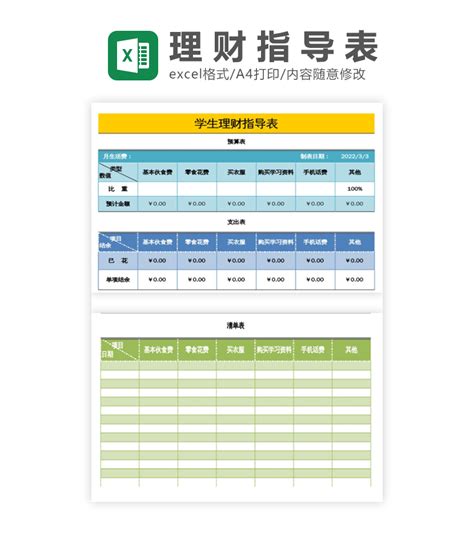

Teaching financial literacy from a young age is crucial for setting a solid foundation for future financial success. Here's a comprehensive financial planning template tailored for a 12yearold elementary student.

Regularly review the financial plan with the student to track progress towards their goals. Adjust the plan as needed based on changing circumstances or priorities.

Introduce the concept of budgeting by creating a simple budget template. Allocate a portion of any allowance or money received as gifts into different categories such as savings, spending, and giving.

Encourage the student to track their expenses to understand where their money is going. This could be done through a simple notebook or using budgeting apps designed for kids.

Teach the importance of delayed gratification by discussing the benefits of saving up for a desired item rather than making impulse purchases. Help them understand that waiting and saving can lead to greater satisfaction in the long run.